Out Form 709" width="400" height="200" />

Out Form 709" width="400" height="200" /> Out Form 709" width="400" height="200" />

Out Form 709" width="400" height="200" />

If you give someone cash or property valued at more than the 2024 annual exclusion limit of $18,000 ($36,000 for married joint filers), you’ll have to fill out Form 709 for gift tax purposes. But don’t fret. This doesn’t always mean you’ll owe an actual tax. The government requires this to keep track of your lifetime gift and estate tax exemption. It’s only when you use up the large lifetime exemption that you would owe an out-of-pocket tax. Still, filling out Form 709 can get complicated. This article will walk you through the process step-by-step. It’ll also help you determine if you need to fill out Form 709 in the first place. We can also help you work with a financial advisor who can guide you through the process so you won’t get in trouble with the IRS.

A financial advisor may be able to help. Match with an advisor serving your area today.

The IRS defines a gift as virtually anything of value that you give to another individual or entity without expecting anything of equal or lesser value in return. It doesn’t have to be cold, hard cash, either. This covers several types of asset and property. That includes a house, car, jewelry and more. It also includes several types of financial accounts such as an investment portfolio.

The following may also be considered gifts:

Nonetheless, the government does give you some wiggle room. Giving money to the following individuals or institutions is never considered a taxable gift:

So you can give as much as you want to those individuals and institutions for the year without needing to fill out Form 709 or pay a gift tax.

But even if you think you’ve given away a lot in taxable gifts, you may not need to fill out Form 709 or pay a tax. That’s because of the gift tax limits.

Out Form 709" width="728" height="400" />

Out Form 709" width="728" height="400" />

For tax year 2024, you may give someone cash or property valued at up to $18,000 without needing to fill out Form 709. The exclusion applies per person. So you can give your son, daughter and grandchild $18,000 each without catching Uncle Sam’s attention. For married couples making joint gifts to a third party, the annual exclusion for the 2024 tax year is $36,000.

The annual exclusion rose slightly from 2023 when the IRS allowed tax-free gifts of up to $17,000 per gift per person.

But once you transfer a taxable gift valued above those limits to any one person, you have to fill out Form 709. Officially, it’s called the United States Gift (and Generation-Skipping Transfer) Tax Return.

If you make a joint gift with your spouse, each individual must fill out a Form 709. There is no joint Form 709.

However, you won’t need to pay an actual tax unless you go beyond your lifetime gift and estate tax exemption. The Trump Tax Plan raised those limits to $13.61 million per individual for tax year 2024 (up from $12.92 million in 2023). But with some wise estate planning and help from a financial advisor, a married couple can shelter twice as much.

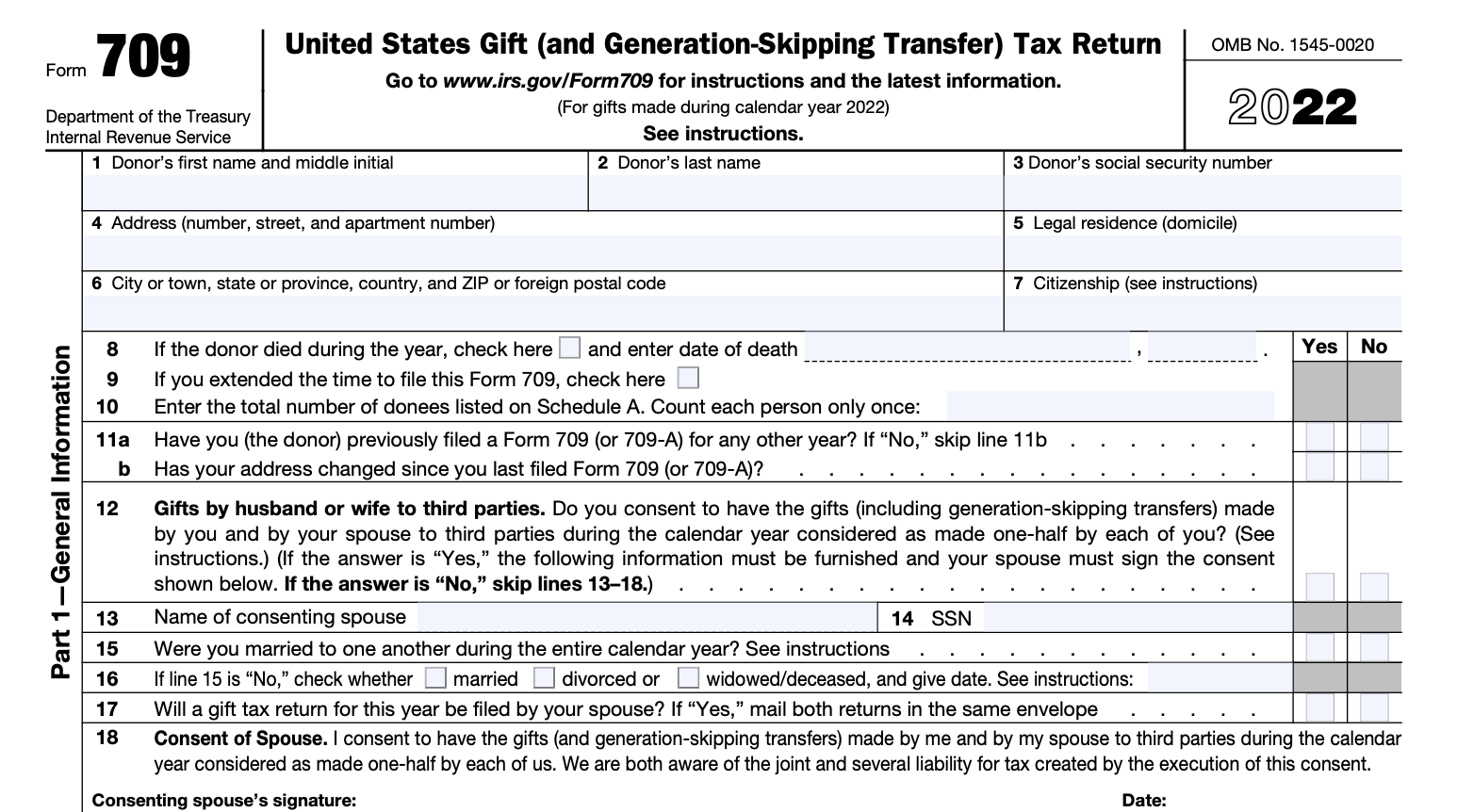

If you’ve figured out you must fill out Form 709, follow the instructions below.

Out Form 709" />

Out Form 709" />

First, complete the General Information section on part one of the form. Line 12 would also allow you to check off on whether you and your spouse made joint gifts for the tax year. If not, you may skip lines 13 through 18. Note that your spouse must also sign Form 709 in the appropriate spot if you made joint gifts. But each would have to fill out his or her own form.

Out Form 709" />

Out Form 709" />

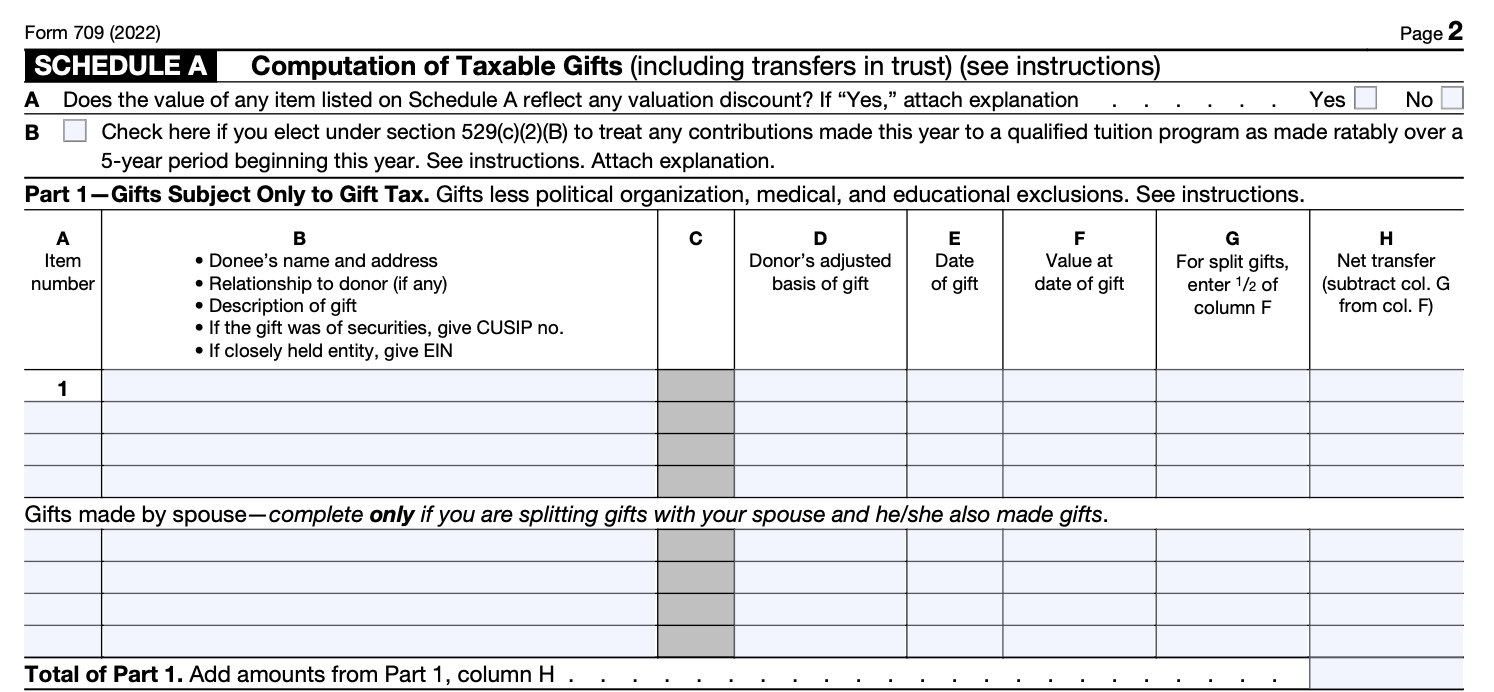

Report the gifts on Schedule A: Computation of Taxable Gifts. Here, you’d provide information such as a description of the gift, the recipient, and its value at the time it was made.

Out Form 709" />

Out Form 709" />

You may also report transfers subject to the gift tax and/or generation-skipping transfer tax if applicable. In addition, you’d report transfers made to trusts if any.

Out Form 709" />

Out Form 709" />

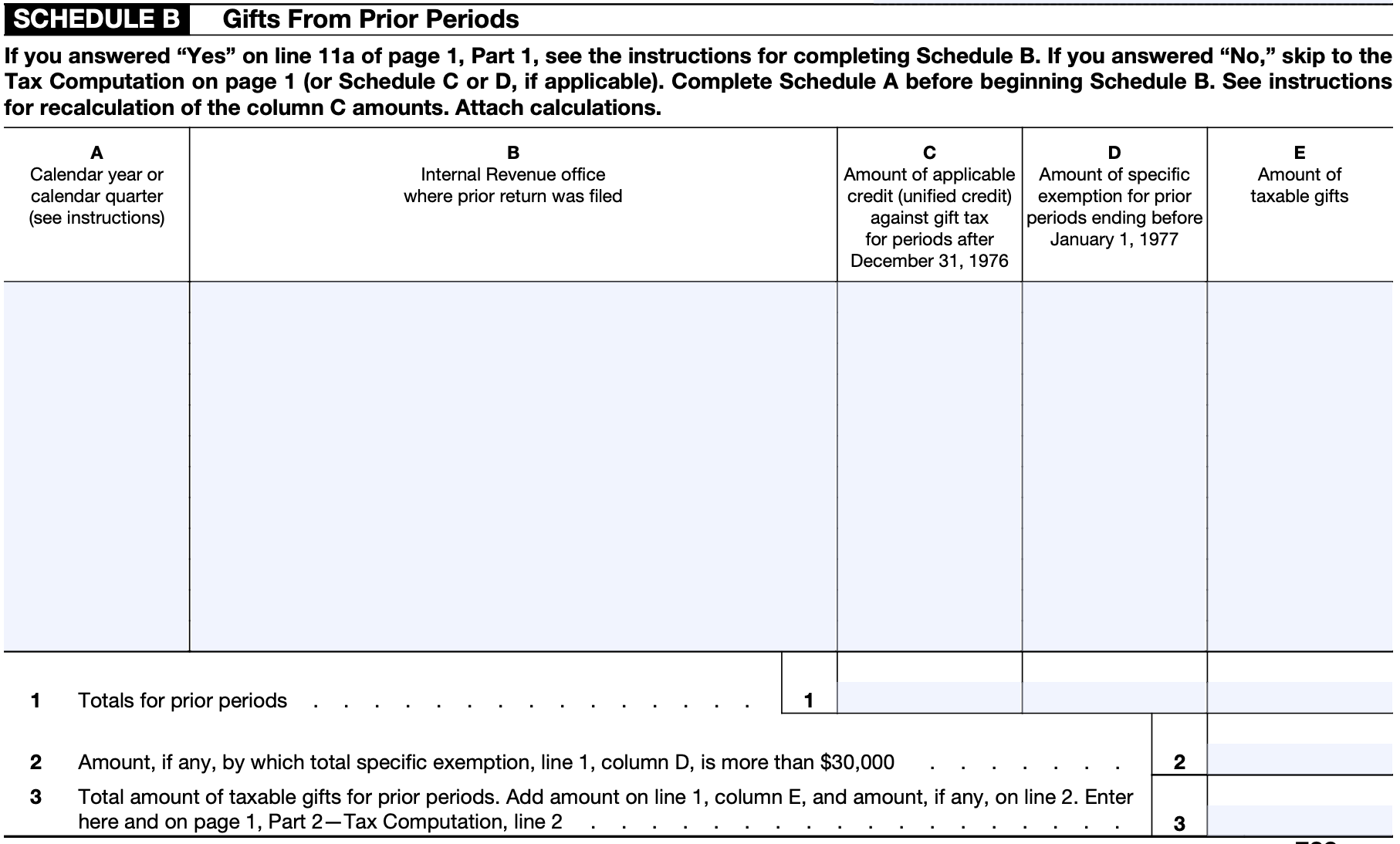

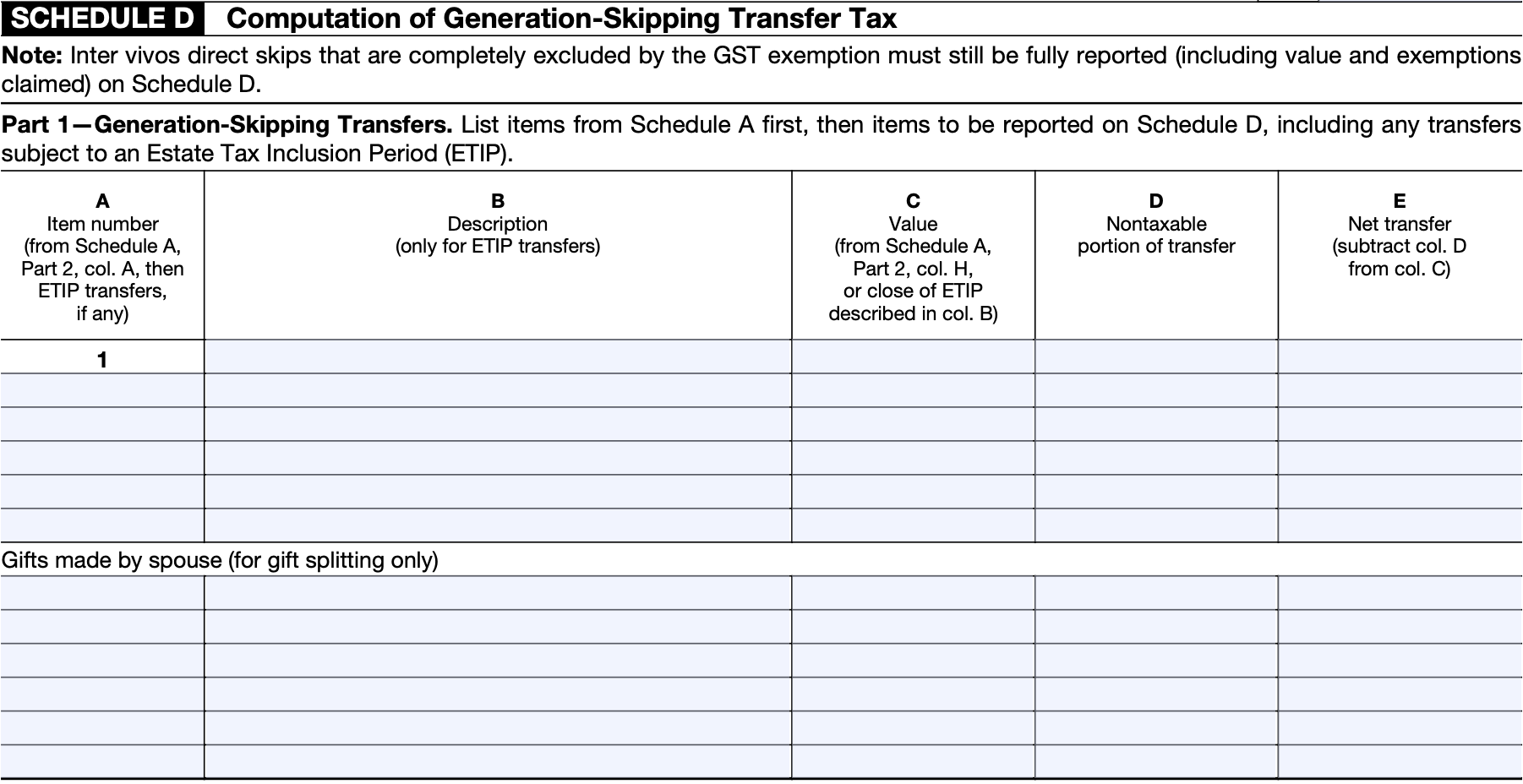

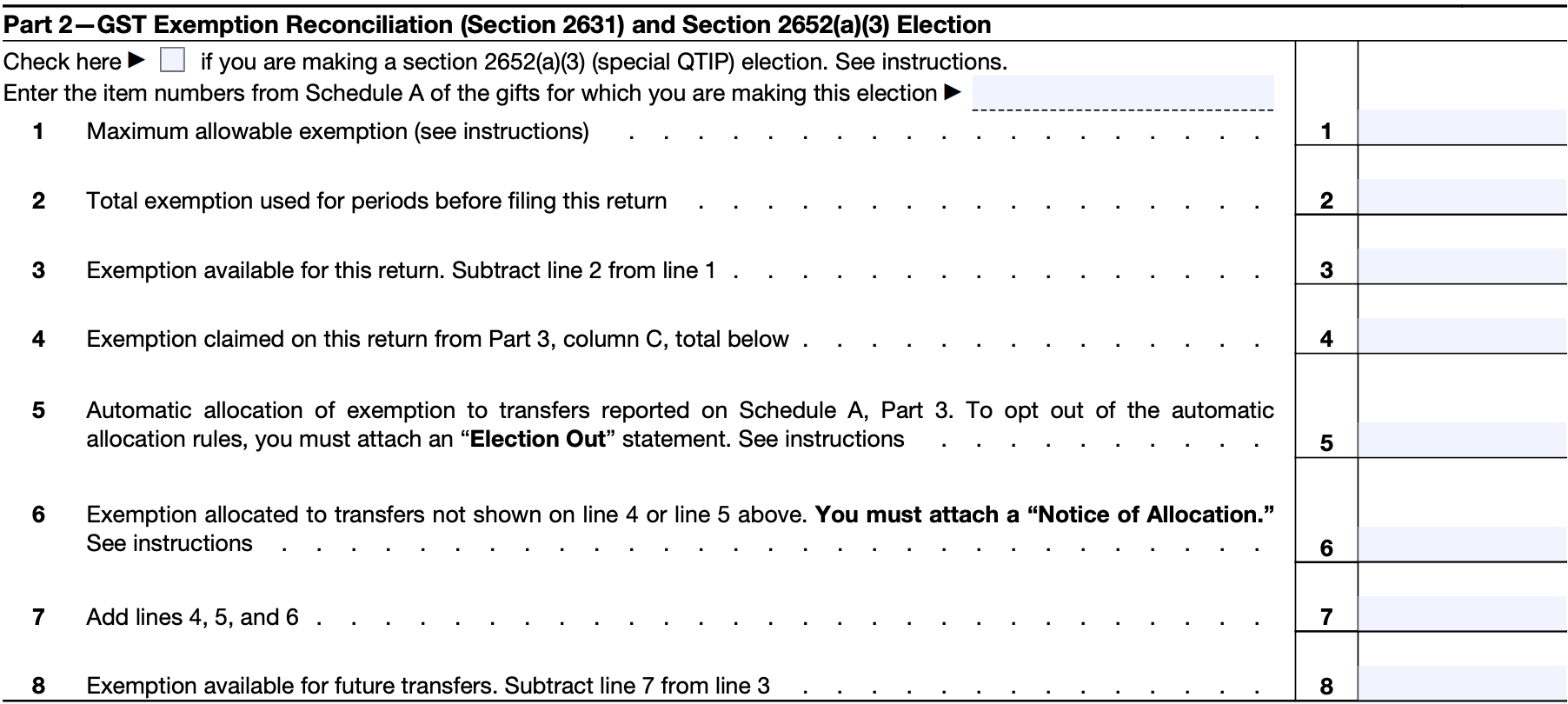

If any applies to you, complete the sections titled Gifts From Prior Periods, Deceased Spousal Unused Exclusion Amount and Computation of Generation Skipping Transfer Tax. These are Schedule B, C, and D, respectively.

Out Form 709" />

Out Form 709" />

Complete Schedule D if you reported gifts under part two or three of Schedule A.

Out Form 709" />

Out Form 709" />

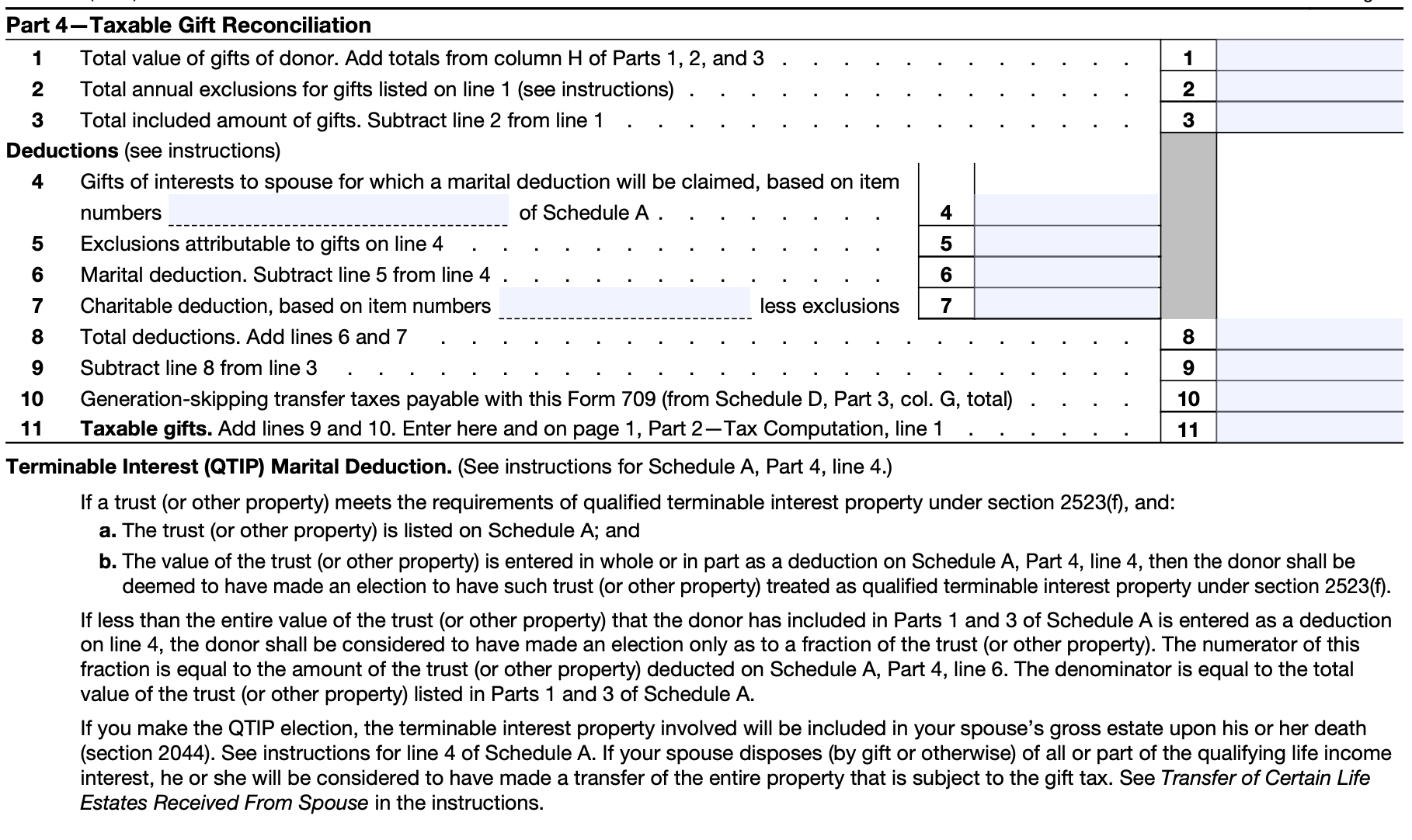

Fill out Schedule A, Part 4: “Taxable Gift Reconciliation.” Here, you may apply deductions or exclusions if any.

Out Form 709" />

Out Form 709" />

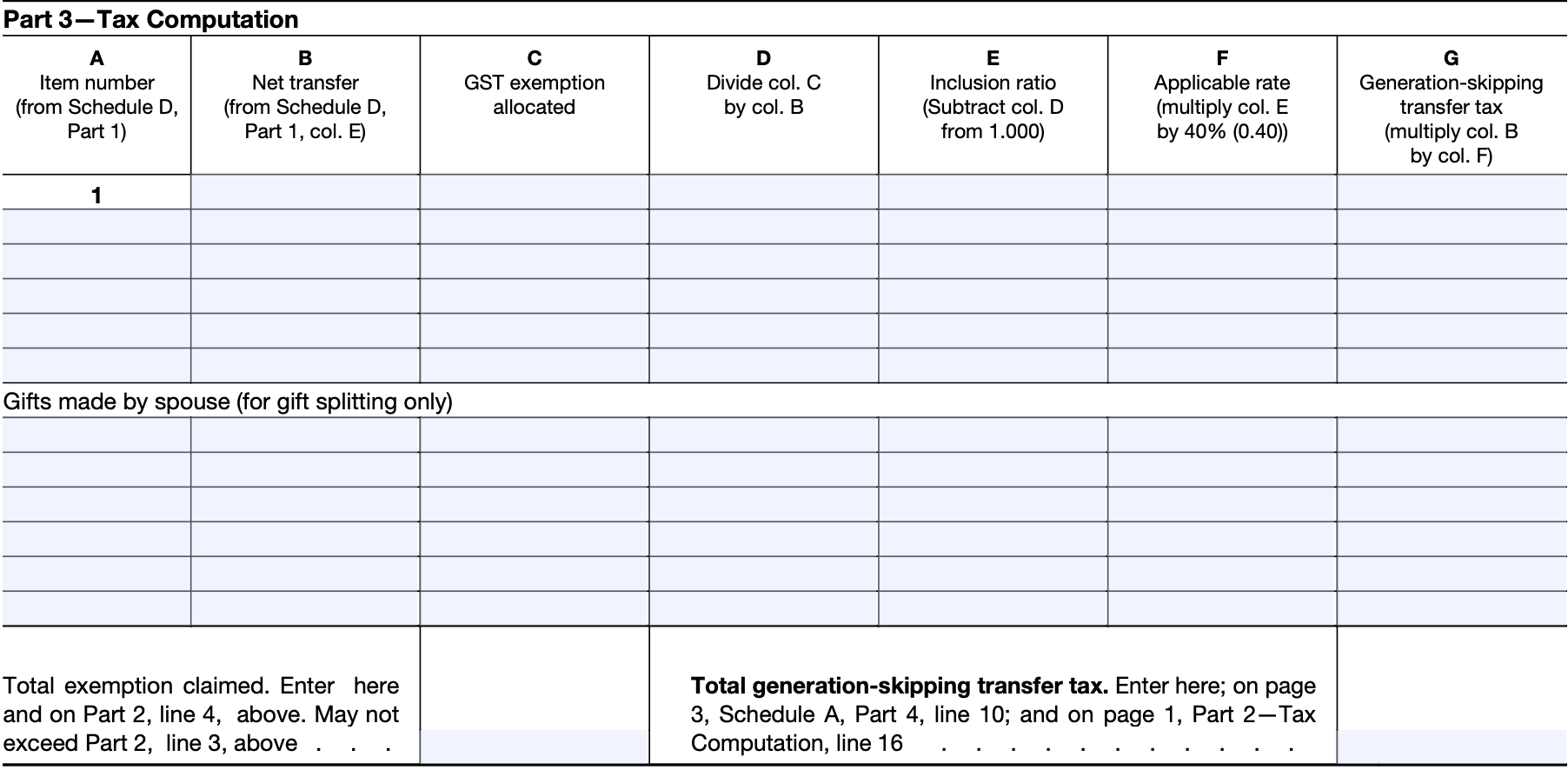

Complete Part 3, known as “Tax Computation.” It is located on the first page of Form 709. Refer to the “Table for Computing Gift Tax” under instructions to calculate the tax on the amount of reported gift or gifts. You may apply your lifetime gift and estate tax exemption, also known as the unified credit. So you don’t have to pay an out-of-pocket tax if you use this exemption. It will, however, reduce how much you can give and transfer out of your estate tax-free in the future.

Out Form 709" />

Out Form 709" />

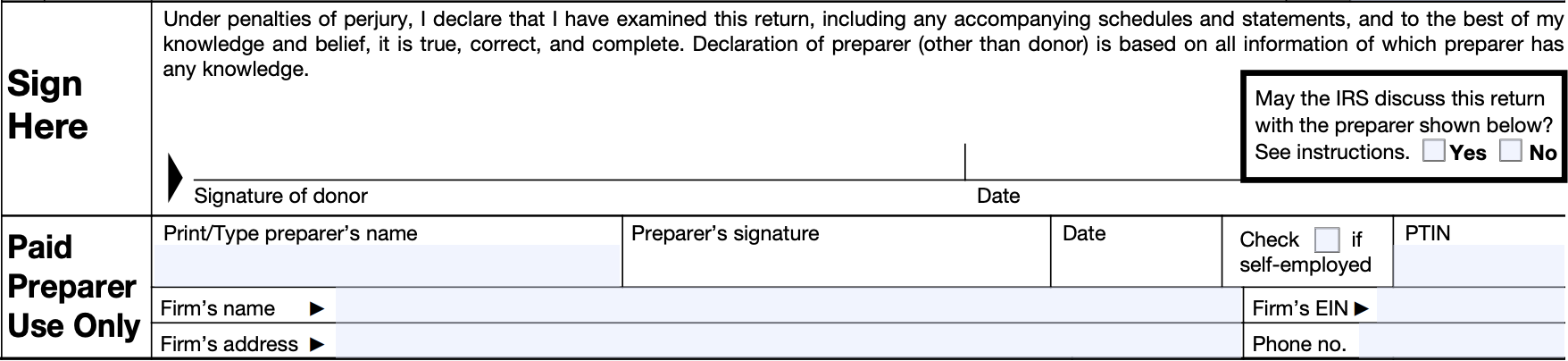

Finally, sign and date the form.

Unless you made a taxable gift valued at more than $17,000 to an individual or entity in 2023 or more than $18,000 in 2024, you don’t need to fill out Form 709. If you did, you may just need to report the gift. You won’t owe an out-of-pocket tax until you’ve given more than your lifetime gift and estate tax exemption. That currently stands at $13.61 million for tax year 2024 and $12.92 million for tax year 2023. But with guidance from a financial advisor, a married couple can safely transfer nearly twice as much tax free.

Out Form 709" width="1024" height="535" />

Out Form 709" width="1024" height="535" />

Photo credit: ©iStock.com/Andrei Barmashov, ©iStock.com/Andrii Yalanskyi, ©iStock.com/LIgorko

Javier Simon, CEPF®Javier Simon is a banking, investing and retirement expert for SmartAsset. The personal finance writer's work has been featured in Investopedia, PLANADVISOR and iGrad. Javier is a Certified Educator in Personal Finance (CEPF) and a member of the Society for Advancing Business Editing and Writing. He has a degree in journalism from SUNY Plattsburgh.

Read More About Taxes

More from SmartAsset

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset's services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. SmartAsset receives compensation from Advisers for our services. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user's account by an Adviser or provide advice regarding specific investments.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.